Just in case anyone is curious about how it works…

Your entire income isn’t taxed at the same rate. Each chunk of your income is taxed differently. The first 11k is taxed at 10%, the next 35k is taxed at 12%, the next 50k is taxed at 22%, and it continues on at different intervals after that. This person believed that going from 44k to 45k would then change their tax bracket and their gross income would be taxed at 22%, thus reducing their net income. This is false. Only the amount over the threshold gets taxed at the higher rate. Always take a raise if it benefits you.

This person was clearly joking. Look at their username.

Still too many who don’t know this, it’s best to explain to everyone. I’ve explained it to my mother several times, and she gets it, but then conveniently forgets about that when discussing politics.

I was straight up told getting kicked into a new tax bracket would cost me money when I started working back in the 90s. By someone 3x my age. I believed it, being a wide eyed moron. I didn’t figure out progressive tax rates for like a decade after.

Just shitty one person could cost so many people so much opportunity in life.

I am surprised by the amount of professionally employed homeowning parental adults I have encountered that do not know this.

I’ve heard of people who use this as an excuse to turn down overtime

I’ve tried to explain this to coworkers who claim to want overtime, but are afraid to due to this. They either don’t understand, don’t believe me, or don’t really want to work OT.

It doesn’t help that welfare does actually work this way.

I don’t know the actual figures but my understanding is government assistance tends to work along the lines of “if you make less than $300, then the government gives you $100” so getting paid $350 is actually worse than being paid $290 for example, since going over the threshold cuts off the welfare completely.

If they receive subsidized benefits like food stamps or quantity for free health benefits, they could lose those though. There’s a reason they call it the benefit cliff. My family stayed under that line intentionally for years and when decided to take raises to get out of that cycle, things were worse for a long time.

10k will get you over that hurdle in most cases unless it barely sneaks you over the benefits line. If you shoot past it though, go for it. Thresholds though, I know. Just don’t want anyone not taking a raise due to a misread comment.

As a rule though: Stay updated on the max total assets you are allowed before benefits begin decreasing, and make sure you know what is weighted.

10k is slightly less than an increase of $5/hr in pay for a full-time hourly worker. That would likely be well over of 30% pay-bump for a person working the kind of jobs that usually keep them on those programs. -At least, it would be in my state.

Let’s make it even more simple with some fake numbers to make it super easy.

$0-$10,000 - taxed at 10%

$10,000-$20,000 - taxed at 20%

$20,000-$30,000 - taxed at 30%

If you make 9 and get a raise to 11, seems like you would now pay 20% on all that! But no.

The first 10 is still taxed at 10%, only the extra $1,000 gets taxed at 20%.

If you go to 31, again, the first 10 is taxed at 10, the next 10 is taxed at 20, and only the extra $1,000 gets taxed at 30%.

$10,000-$20,000 - taxed at 20%

Goll durnit, I know 10,000-20,000=-10,000! How I supposed to pay 20% tax on -$10,000?? Do they pay ME money?? Clearly everythin you said is BULLshit!

(This is a joke just to be clear :P)

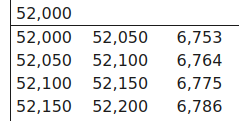

I’m not saying you’re wrong - I completely agree with you. But I have been in the position where, if I made 10 dollars less I would have paid more than 100 dollars less in tax. That just comes from the infuriating discrete tax “tables,” instead of actually calculating the tax using a continuous formula.

ETA: Apparently many here have never prepared their own tax return. Here is a sample of the tax table for 2023. The first two columns give a range of (adjusted) income, and the third is tax owed. Notice that someone who made $51,099 would pay $11 less in tax than someone who made just one dollar more. Admittedly that is less extreme that what I claimed above, but “back in the day” when I started paying taxes the tables went in much larger steps of income.

I mean, I get it, but you could also just look at it like getting an exceptionally good deal right before you hit the next table row.

Sure, but my point is that it is possible to make more money and then actually have less money because of taxes. It’s just not for the reason in OP’s post.

I’m a tax accountant.

You’ll never make less due to income tax for making more money.

You can start to get certain credits phased out and can become subject to things like the Medicare surcharge.

But it’s still unlikely that making more will ever get you less.

In a similar track though, I refused raises for a couple years because my kid was in college. If I got a raise, I would be kicked into the next income tier of financial aid eligibility, and that could’ve been catastrophic. Those lines don’t seem to phase as much as they seem to be hard cutoffs - at least as far as my kid’s specific school was concerned. All of her financial aid (grants, not loans) came directly from the school, not the government.

I also was able to enjoy a little bit of education expense credit on my tax return because if it, but that part was nominal.

The biggest hit has been going from head of household with a dependent tax credit to single with fuck all credits. Fortunately, I can itemize my way into a deduction midway between single and head of household, so I got that going for me, which is nice.

Edit: Wow, that was a gibberish filled gummy induced wall of text. Nothing particularly factually incorrect, but man what a slew of non sequitur.

This legit happened to a college of mine, at his first job (as engineer), it took me well into his second year of employment (the time when he got the second yearly income tax stats) to get him to understand what I’ve been explaining to him since he was offered a raise a few months after he started.

I tried, I really did, with charts, examples, my own income tax statement, … but no.

I never found out which part was bothering him, like theoretically, how tf …

Unfortunately he’s probably drinking raw milk these days. IYKYK.

To anyone with the math skills, I just explain it as a piecewise function. It’s pretty easy to model.

badmoneyguy

username checks out

It’s comparatively unlikely, but there are circumstances where this type of thing can be true. Because income tax is not the only factor that matters. For example, you might get put on too high an income to qualify for some sort of tax rebate or welfare programme. Or you might start qualifying for an additional tax that isn’t applied marginally.

As one specific example, in Australia we have the Medicare Levy Surcharge, which you pay if your income is above a certain threshold and you’re above a certain age and don’t have private health insurance. If those conditions are met, it applies to all your income. It’s a small enough surcharge (ranging from 0% to 1.5%, with 1% and 1.25% steps in non-marginal brackets in between) that there are almost no practical circumstances that you’d actually end up worse off taking a raise, but it is at least theoretically possible.

Yup. It’s called the “welfare (or benefits) cliff”. It tends to happen at the lower end and the. Again at the upper middle end. There are quite a few tax breaks in the US you can’t take once you pass an AGI of $160-175K. Depending on if you were taking them, a raise could technically result in less net income.

Don’t forget at that level you’re also approaching the SSI cap (168k for 2024), which more than offsets losing those other breaks.

someone failed at teaching this loser mathematics.

Way too many people don’t understand how marginal tax rates work.

Just went through this with my dad. He got ‘right-sized’ about a year ago and has been job hunting. He called me (praise jeebus) to ask me for advice about negotiating a slighly lower starting salary because his offer on a new job was about $140 over the line into the next bracket and he didn’t want to ‘lose’ all that extra salary to taxes.

We spent about an hour on a video chat where I ended up pulling up the IRS page about it as well as going line by line through the tax tables so I could show him how it actually works. He was flabbergasted and kept asking how could every single person he knows be wrong about this.

Check his username before you eat the onion next time.

US public education system doesn’t teach anything related to real-world finances, including how tax brackets work.

I learned how taxes work when I was in 8th grade and then again in high school.

Depending on the tax system that is an actual issue.

At least in the US there is no possible situation where you’d get less money for making more money.

I don’t believe that’s actually true. I think in the USA there are a few programs that have a hard cap on income to disqualify you. Food and housing assistance related things. I’m not American so I’m not 100% sure on them but I do think there are some scenarios

That’s true. You’ll still be making more money, but you’ll also have more expenses. This doesn’t apply to most people though, and for sure not ones getting a $10k raise. The progressive tax system we have only applies the tax as you progress through the levels. The first $10k will be taxed at one level, then the next bracket, then the next, etc. It’s not done as one lump tax.

Different programs should be set up to slowly decrease how much you get instead of cutoff amounts. That’d remove that issue. Obviously some things are either on or off so they can’t be done this way though. Ideally a lot of it should just be provided to everyone no matter what though.